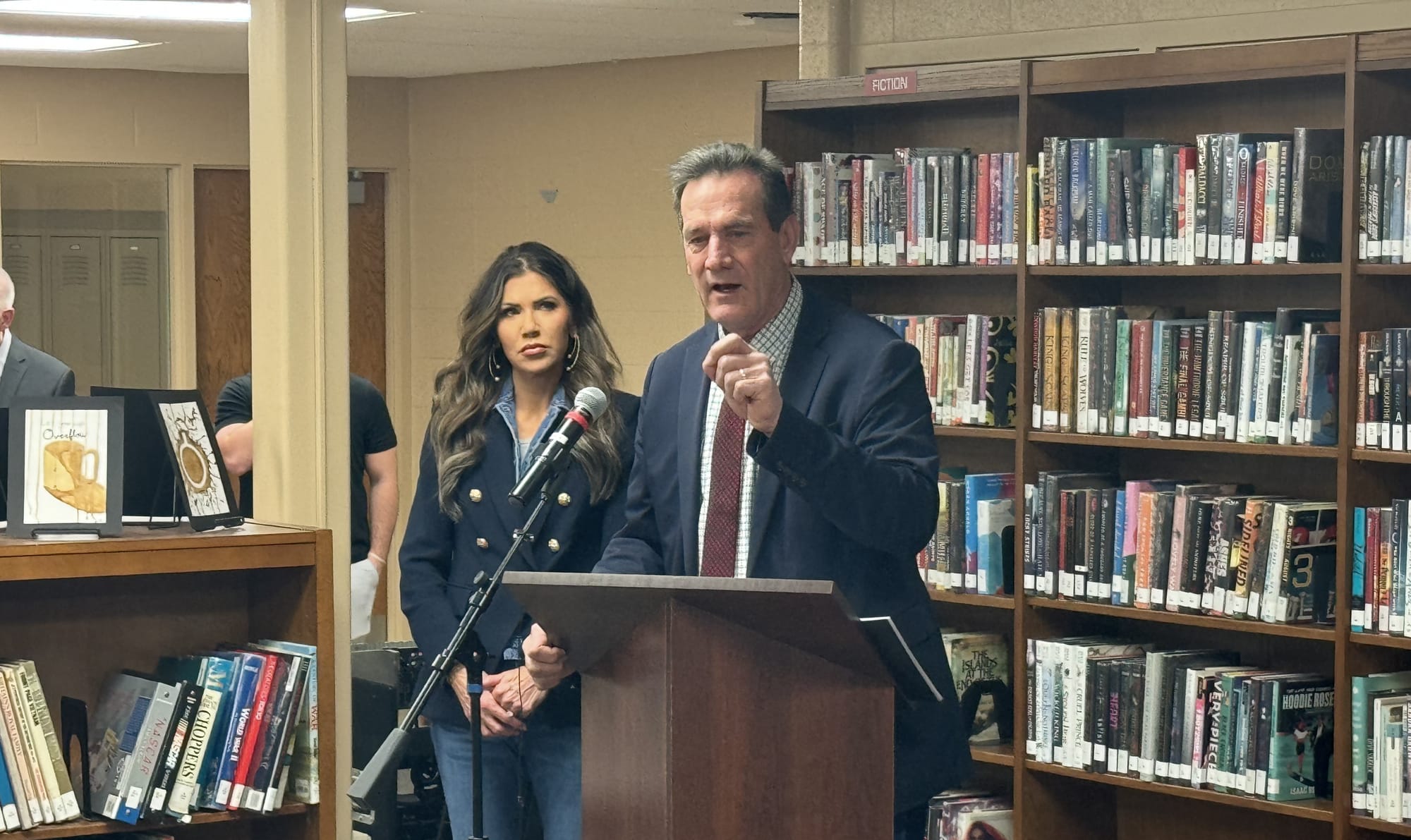

Gov. Kristi Noem plans to deliver her final budget address Tuesday at the South Dakota State Capitol in Pierre, outlining her economic vision with an eye toward the next stage of her political career.

It’s natural for governors to emphasize the positive in these circumstances, but legislators might not have that luxury at a time when lagging state revenue and rising expenses signal significant belt-tightening for the 2025 session, where the budget for fiscal year 2026 will take shape.

“I don’t envy the governor’s position in putting out this budget,” said Rep. Will Mortenson, who served as Republican House majority leader the past two years. “If you’re someone coming into this session planning to create some big new government program or spend a bunch of money in a new way, you're going to be in for a rude awakening. We're just not going to have the money.”

That’s a marked contrast to the “foot on the gas” mantra pushed by Noem the past few years, when federal stimulus money and inflation-fueled sales tax receipts fattened state coffers.

Last year's budget proposal for fiscal year 2025, largely adhered to by the Legislature, called for $7.3 billion in spending, an increase of nearly 30% from two years earlier.

After budget increases to the big three – education, health care providers and state employees – ranging from 5% to 7% the past three years, a more modest hike is expected for FY 2026 due to flat overall revenue, prison construction costs and a larger state share of Medicaid payments.

“You've got ongoing sales tax collections that are $22.5 million behind legislative projections, you’ve got a men’s prison with a high maximum cost of $825 million and you’ve got conversations about property tax relief coming up,” said Nathan Sanderson, executive director of the South Dakota Retailers Association.

“Just on those conversations alone, it’s going to be a very tight budget year, and I don't know what the answers are going to be.”

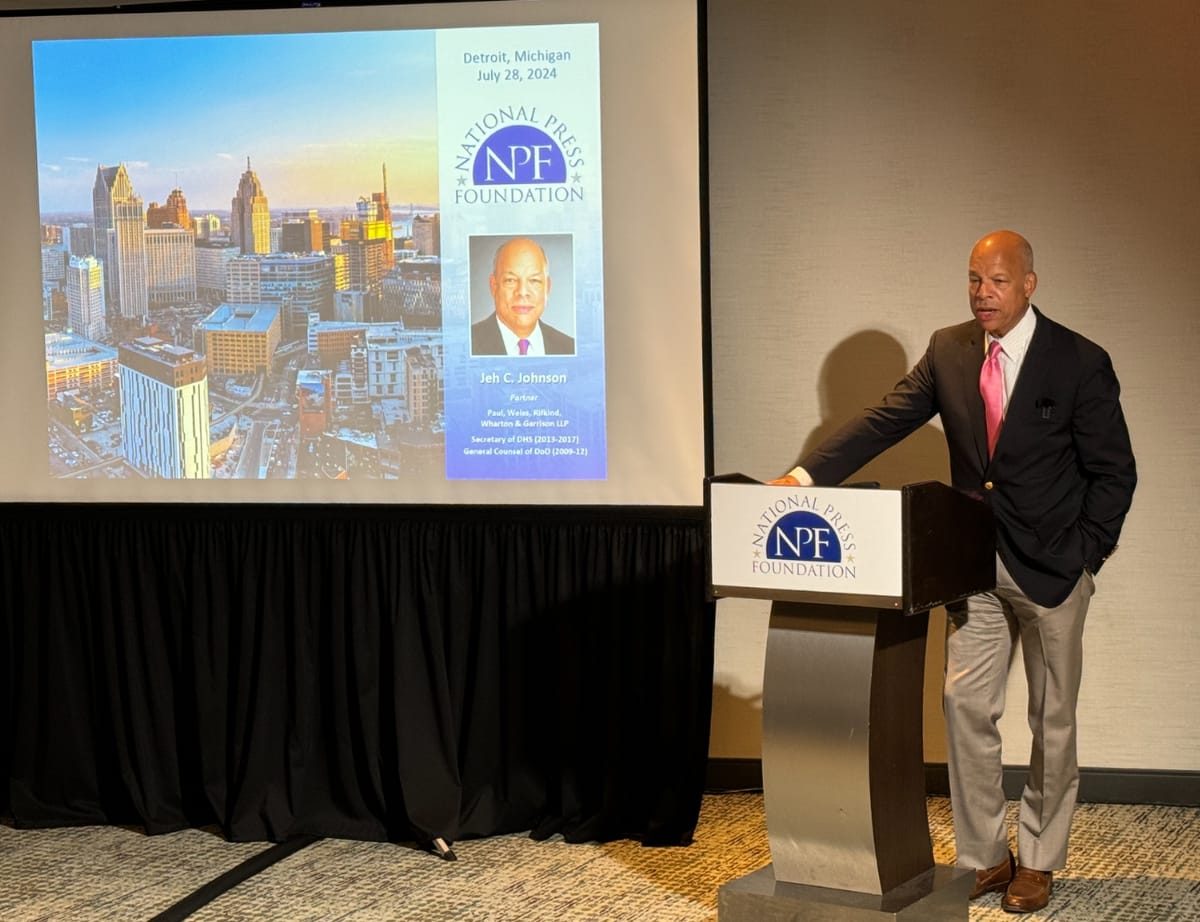

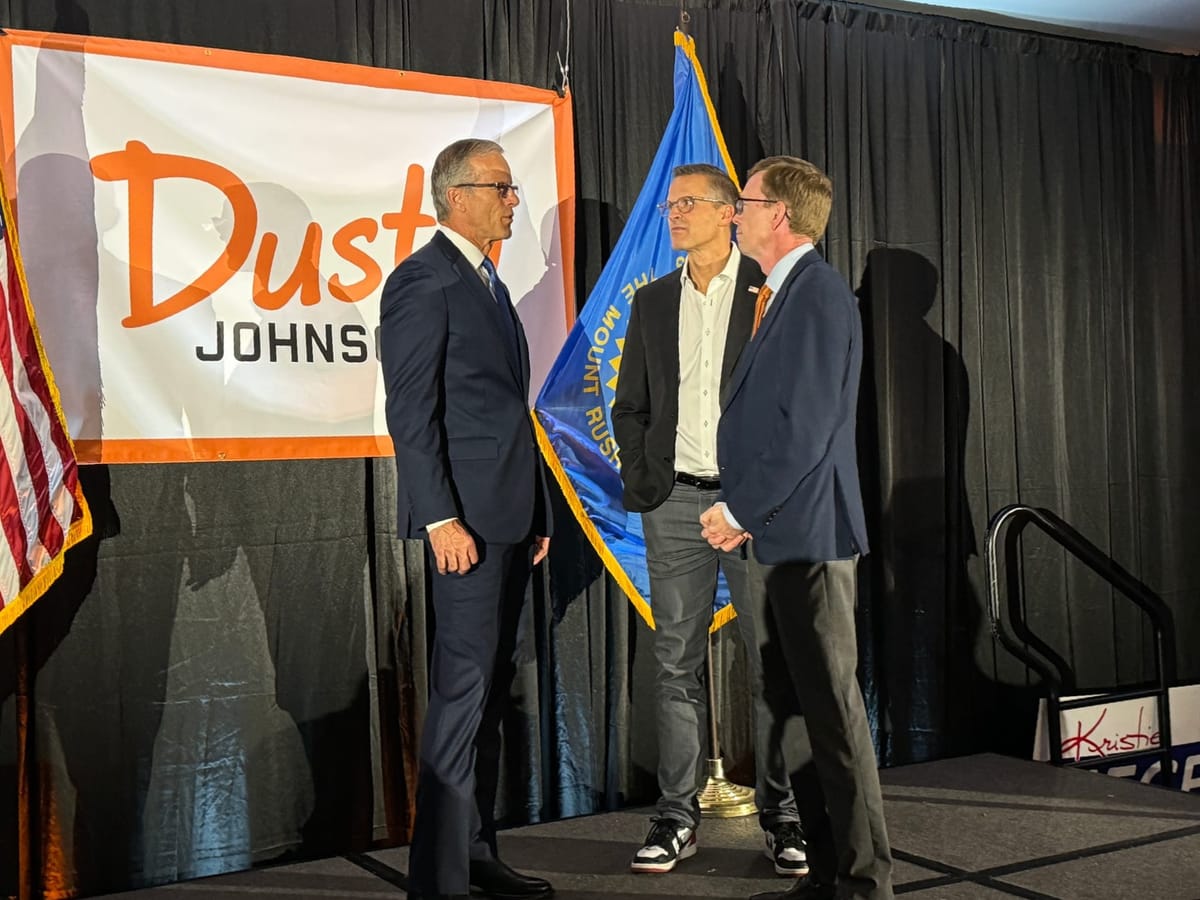

With Noem nominated as Homeland Security secretary and preparing for confirmation hearings, the long-range responsibility will fall to Lt. Gov. Larry Rhoden, who could become the first South Dakotan to take the oath of office in the heat of a legislative session.

The fact that the 65-year-old Meade County rancher is a veteran lawmaker is not lost on those who will work with him to try to make fiscal austerity a guiding principle again in Pierre.

Rhoden served in the state House of Representatives from 2001-09 and 2017-19, including a stint as majority leader from 2005-08. He served in the state Senate from 2009-2015 and chaired the State Affairs Committee.

“Changing horses in the middle of the stream (during session) is unprecedented, and I don't think any of us know what to expect,” said Mortenson. “It creates an opportunity where the budget proposed by one governor at the beginning can be adopted and defended in total, or it can be amended in partnership with the legislature. As long as we've got a healthy working relationship with both governors, but probably more importantly with the incoming governor, people shouldn't see a whole lot of disruption.”

Here's a look at key factors to watch heading into Noem’s budget address and the 2025 legislative session in Pierre:

Sales tax revenue falling short

At a meeting of the Joint Committee on Appropriations on Nov. 14 in Pierre, state economists outlined revenue trends showing that sales tax collections for July through October were $22.6 million behind legislative projections, more than 4%. That trend could lead to a shortfall of nearly $80 million compared to projections for the fiscal year, which ends June 30.

Overall tax receipts for fiscal year 2025 fell nearly 3% short of expectations through October.

“There are areas that seem to be showing more weakness than others,” Derek Johnson, an economist with the Bureau of Finance and Management, told legislators. “Areas like building materials, hardware, garden supply, home furnishings, durable goods and communications. And then our farm equipment is down as well.”

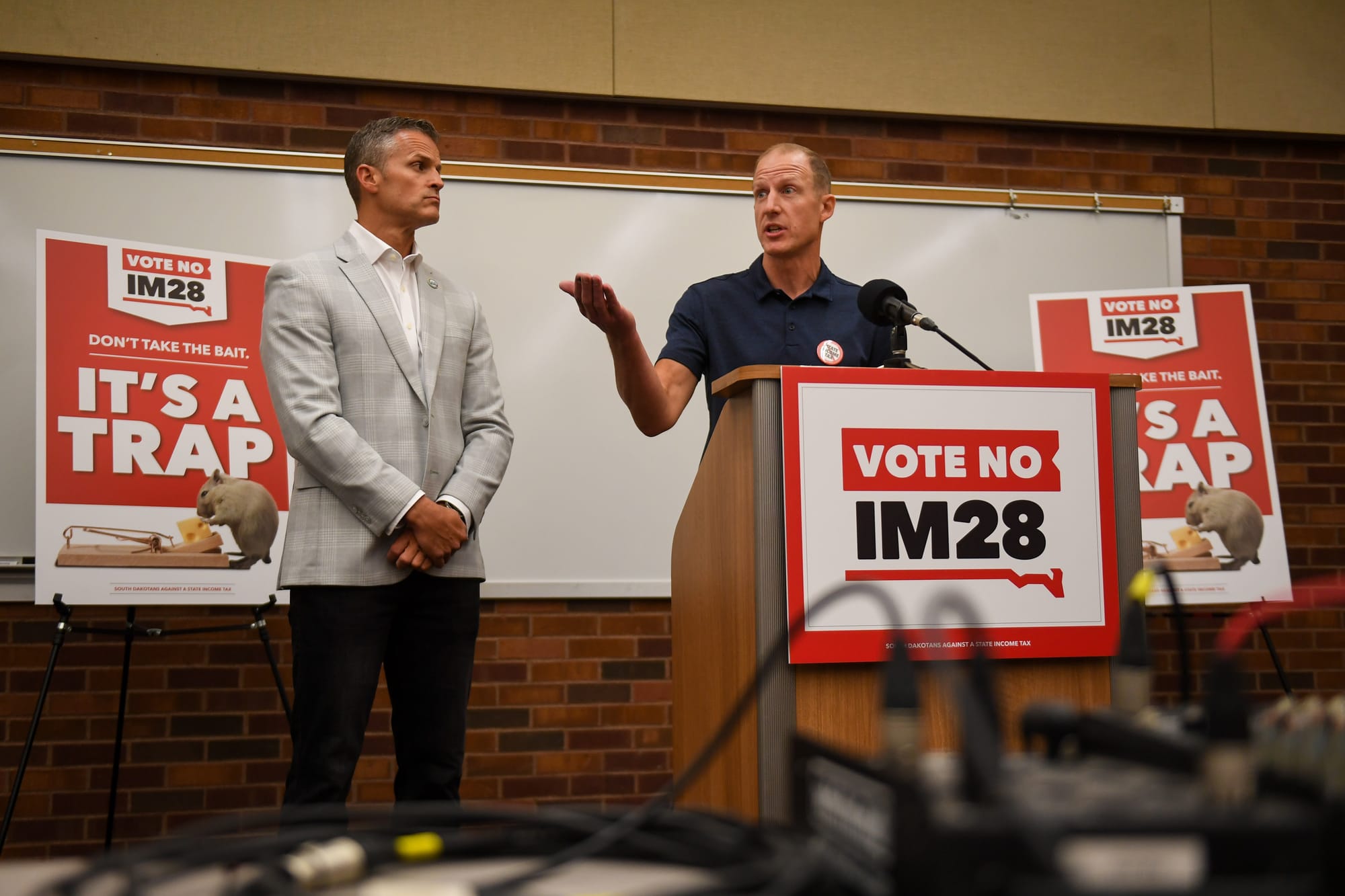

Sales taxes are the largest source of state government revenue in South Dakota, one of seven states without a state income tax. The revenue ceiling is lower because legislators voted during the 2023 session to lower the general sales tax rate from 4.5% to 4.2%. That rate sunsets, or expires, in 2027.

Talk of eliminating that sunset clause and making the sales tax cut permanent might lose steam in this year’s session based on the latest state revenue projections.

There are limited ways to fill the revenue void in a volatile economy, with consumers finding a new normal on the heels of federal pandemic stimulus and surging inflation rates. The current U.S. inflation rate is 2.6%, compared to 3.2% at this time last year.

“People might ask, ‘Why is consumer spending sluggish?’” asked Sanderson, who served as a policy adviser to former Gov. Dennis Daugaard. “Well, we got a whole bunch of money from the feds during COVID. Those dollars have gone away. And we've seen nationally that credit card debt has increased and savings have decreased. I think people are starting to realize that their former spending habits weren't sustainable, and so they're starting to tighten the belt a little bit.”

Problems with property tax relief

When the decision was made to temporarily lower the general sales tax rate in 2023, the other two options were to repeal the state’s grocery tax, which Noem supported, and to provide property tax relief.

Voters strongly rejected a grocery tax repeal in the 2024 election, at least temporarily taking that issue off the front burner.

But property tax is a hot topic entering the 2025 session, given that total payments have increased by nearly 60% for homes and nearly 50% for commercial property over the past decade in South Dakota.

The problem with cutting property taxes, which help fund local school districts and city and county governments, is that typically you need to backfill that lost revenue with general fund dollars to pay for education and reduce the local effort for school districts.

That was the formula when former Gov. Bill Janklow pushed through a 30% property tax reduction in 1995, offsetting the lost tax revenue to schools by increasing the state's education contribution. The program also updated the state’s education aid formula and established property tax caps.

The difference this time around is that finding money to supplement the education fund will be daunting at best, leaving less aggressive options on the table such as improving the efficiency and accuracy of property tax assessments.

The South Dakota Retailers Association supported property tax relief back in 2023, when legislators opted instead to cut the general sales tax rate. Sanderson said current economic conditions make it more realistic to view the higher rates as a free-market function that ebbs and flows.

“The reality is that most of the property tax challenges are coming because the value of property, particularly in places like the Black Hills and Minnehaha and Lincoln Counties, has just gone up," he said. "And so it's hard to provide property tax relief when the value of the thing being taxed is increasing exponentially. This probably sounds very bureaucratic to say, but some of this is going to just work itself out naturally.”

Prison project looms amid budget talk

South Dakota Department of Corrections officials told legislators at the Nov. 14 meeting that the guaranteed maximum price for a planned new men’s state prison is $825 million, higher than previous estimates.

That includes $737 million in construction for the 1,500-inmate facility at the proposed site between Harrisburg and Canton in Lincoln County, making it the largest one-time capital investment in state history.

The fact that the prison involves “one time” dollars puts it on a different tier of budget discussion from ongoing expenditures such as health care and education funding.

But there are still concerns about higher-than-expected costs and the assessment of operational expenses for the new facility, which would replace the current Sioux Falls penitentiary that was built in 1881.

The Legislature has already committed $87 million to build a new women's prison in Rapid City, with a likely completion date of early 2026.

Corrections Secretary Kellie Wasko told appropriators that the decision to construct a men's prison “has not been made hastily,” adding that there have been six bills related to the project that “had hearings, legislative discussion and were passed by the Legislature.”

That process led to $628 million being placed in a state prison fund, which, accounting for interest and money spent, would leave about $200 million left to fund and green-light the project.

Noem has proposed using $80.7 million in budget surplus from FY 2024 for prison construction, underscoring her desire to get the project finalized during her second term. That surplus money was transferred to the state's budget reserves, which now total about $323 million.

Now that Noem could be leaving for a Cabinet position in Washington, her interest in allocating money to the prison might gain urgency.

State Rep. Tony Venhuizen, a Republican member of Joint Appropriations, said he hopes the payoff target of $200 million could be reached during the 2025 session.

"It's very smart to pay cash if we can, and the cost will only go up if we wait," said Venhuizen, a former chief of staff to Noem and Daugaard.

Mortenson, however, is skeptical of the target being reached this session given budget realities and opposition to the proposed site from members of the Republican Party’s populist faction, some of whom have moved into leadership roles.

“Even if everyone wanted to, I'd be very surprised if we could come up with the dollars to completely fund the bottom-line price for the men's prison,” Mortenson said. “That’s probably going to take another couple of years.”

State's Medicaid payments going up

South Dakota voters passed Medicaid expansion in 2022, extending health care coverage to more low-income residents under the Affordable Care Act, with the federal government covering 90 percent of the cost for the first three years.

That "bonus" in federal payments ends this year, said Venhuizen, who opposed expanding Medicaid without a plan to pay for the state's share. That price tag is about $35 million for FY 2026 after the state set aside $31 million earlier to ease the cost.

"The good news is that the Legislature and the governor planned for this by beginning to build in these extra costs over the past two years," said Venhuizen. "The bad news is that we have to absorb the rest of it this year, which means it will limit available ongoing revenue that much more."

Additionally, the Federal Medical Assistance Percentage (FMAP) for regular Medicaid has changed for South Dakota, with the state's funding responsibility increasing from 45% to 47%, which means as much as $25 million for FY 2026.

That's a total of nearly $60 million for Medicaid-related expenditures in a budget already facing headwinds, making Noem's budget address not as rosy as a potentially outgoing governor would like to deliver.

"With no revenue growth and $60 million that we know we have to spend on Medicaid for no additional services, you start out way behind the 8-ball," said Mortenson. "I would characterize this as going back to a more normal budget year for South Dakota, meaning a lean budget year."

This story was produced by South Dakota News Watch, an independent, nonprofit news organization. Read more in-depth stories at sdnewswatch.org and sign up for an email every few days to get stories as soon as they're published. Contact investigative reporter Stu Whitney at stu.whitney@sdnewswatch.org.